The oilsands are a Canadian success story and an increasingly rare example of Canadian innovation, says a report that aims to contribute to a better understanding of the oil industry.

“A national project: How oil sands investment and production benefit Canada’s economy” concludes that both higher investment and higher production in the oilsands raise gross domestic product (GDP) by similar amounts, but the increase in investment leads to more jobs created than an increase in production.

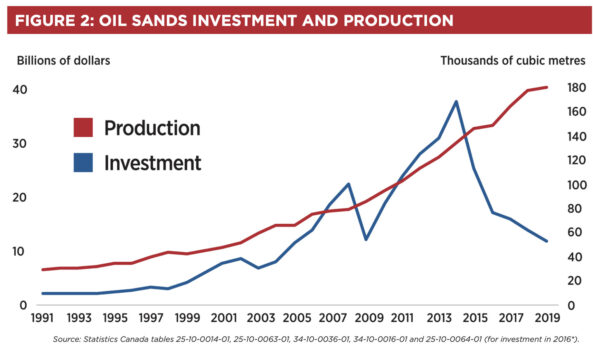

Authored by Macdonald-Laurier Institute senior fellow Philip Cross, the report determines that spending on production is more stable than investment in downturns. Oilsands production is more resilient to industry downturns than conventional or shale operations, it adds.

Thus, investment in the oilsands tends to be more cyclical than production, which doesn’t necessarily decline when prices fall due to the high level of fixed costs, according to the report. With high fixed costs, little is saved by lowering output, and raising production lowers the average cost to produce.

The report analyzes that a $10 billion investment in the oilsands would raise Canada’s GDP by 0.5 percent. The corresponding increase in jobs would be 81,734 or 0.4 percent of all the jobs in Canada, whereas the increase in jobs from a $10 billion increase to production would lead to a gain of 38,237 jobs or 0.2 percent.

“For investment, 18.3 percent of the GDP generated accrues to other provinces—worth $1.920 billion in absolute terms. In the case of higher production, 13.5 percent of the increase in GDP, or $1.415 billion, accrues to the rest of Canada,” the report says.

The jobs created in Alberta tend to be extremely lucrative, paying on average $214,000 annually, based on 2017 data. But the report says that average pay in a region declines if it is not directly involved in oilsands work.

Ontario captures about half the increase in jobs outside of Alberta from both higher investment and production, but few benefits reach the Atlantic provinces, according to the report.

Cross argues that innovation in the oilpatch is a “stellar example” of how “Canadian ownership and Indigenous participation can help boost the economy.” For example, he points out that Alberta has developed unique technology and expertise for the oilsands that large international players don’t have.

“It will then be important for the industry and governments in Canada to set the public record straight on what this industry has accomplished and its importance to Canada’s economy,” Cross writes.

Changing a Bad Rap

Canada’s oilpatch is in an ongoing battle against some negative media and public perceptions such as the “disparaging and completely inaccurate description as the ‘tar sands,’” Cross writes.

“Media portrayals rarely present what an oil sands mine looks like after the land has been rehabilitated, something all companies must commit to and set aside funds for when they begin operations,” says the report.

But the oilpatch’s record of hard work and innovation gives the industry hope.

“To protect the large investments already made in the oil sands against its demonization by its opponents, further innovation will be required to further lower operating costs and emissions. The track record of relentless innovation by the industry suggests such an outcome is eminently possible,” states the report.

The report makes a strong case for the oilsands as its market share in the United States is growing—the current 3.8 million barrels a day exported to the United States is expected to rise to between 4.2 and 4.4 million barrels a day over the next few years.

Be the first to comment