Commentary

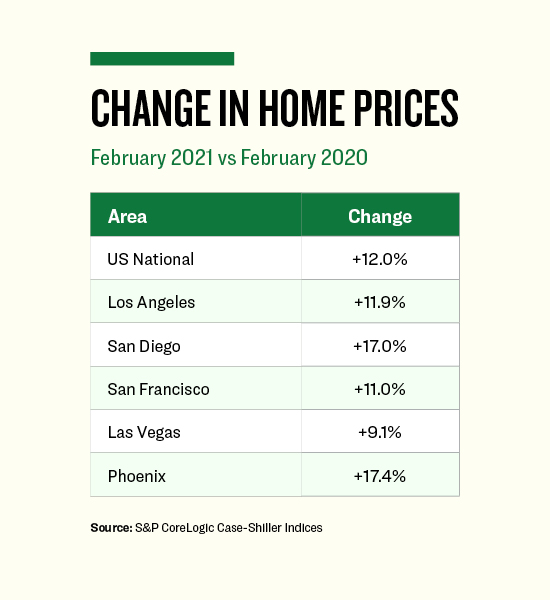

Home prices in the U.S. increased in value during the past year at the fastest pace since the end of the 2006 real estate bubble that led to the Great Recession.

Standard & Poors (S&P) compiled an index of home prices using an analytic framework developed by economic sciences Nobel laureate Robert Shiller and data from CoreLogic. Its national real estate index, as well as indices for 20 cities, is the best set of data for comparing actual home prices through time.

It compares a home’s actual sale price to the last time that individual homesold.

Data for February 2021 from the S&P CoreLogic Case-Shiller data released on April 27 showed that home values in the U.S. increased 12 percent over the year-ago period. Perhaps most striking about the increase is that its comparative month, February 2020, occurred one month before the pandemic hit the U.S.

S&P managing director Craig J. Lazzara said: “These data remain consistent with the hypothesis that COVID has encouraged potential buyers to move from urban apartments to suburban homes.”

Lower rental levels in city centers such as San Francisco and Los Angeles, and higher home prices seen in suburban real estate markets, buttress this idea.

Future Demand is Unknown

Home prices within the Los Angeles region climbed about the same amount as nationally; its home prices rose 11.9 percent in February 2021 from the year-ago period.

San Francisco home prices did not quite keep pace, with home prices there up 11 percent.

San Diego home prices, however, increased very rapidly. Its home prices rose 17 percent from the year-ago period. Home prices in San Diego last went up that quickly in 2013, when home prices increased 18 percent.

Said S&P’s Craig J. Lazzara: “The demand [for suburban homes] may represent buyers who accelerated purchases that would have happened anyway during the next several years. Alternatively, there may have been a secular change in preferences, leading to a permanent shift in the demand curve for [suburban] housing. Future data will be required to analyze this question.”

In other words, now that entertainment venues are re-opening and city center rents are lower, time will tell whether people prefer to remain in the suburbs or return to the city.

Tim Shaler is a professional investor and economist based in Southern California. He is a regular columnist for The Epoch Times, where he exclusively provides some of his original economic analysis.

Views expressed in this article are the opinions of the author and do not necessarily reflect the views of The Epoch Times.

Be the first to comment