This past weekend was tough for some cryptocurrency enthusiasts who not only lost the money they approved on a presale transaction, but they also lost all the money in their Trust Wallet through a deception that gave the scammers access to their entire wallet.

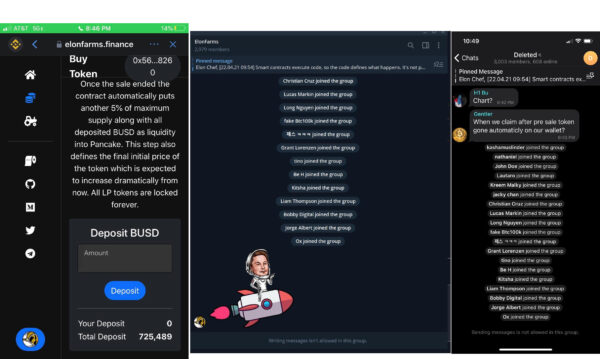

The victims invested in efarms, a new cryptocurrency launched by elonfarms, which operated with a Twitter account (@elonfarms), a website (elonfarms.finance), and a Telegram group (ElonFarms). All these accounts have been either deleted or deactivated.

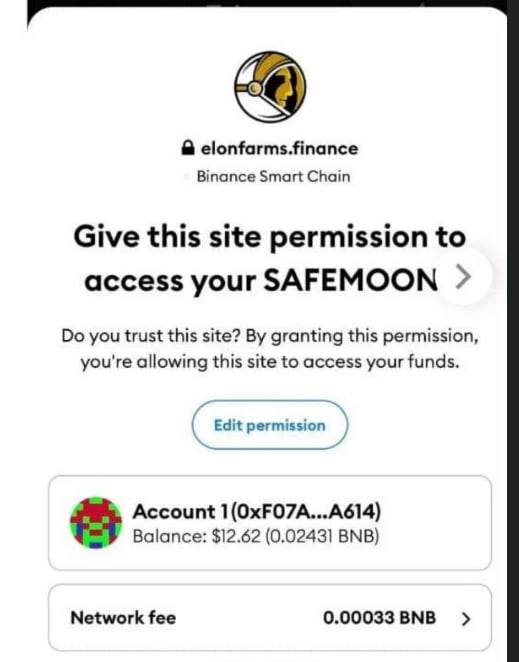

Investors thought they approved a transaction fee to claim the presale efarms coins after the presale ended at midnight of April 23 yet lost all their tokens in their digital wallet Trust Wallet. They found out that the contract they accepted allowed elonfarms access to their entire Trust Wallet rather than the amount they committed. Many lost all their digital assets as a result.

Victims formed a telegram group, “ElonFarmsRugPool,” on April 24 to discuss the next steps. The group accumulated nearly 500 members in two days. Some tracked where the balance of various accounts their tokens were moved to.

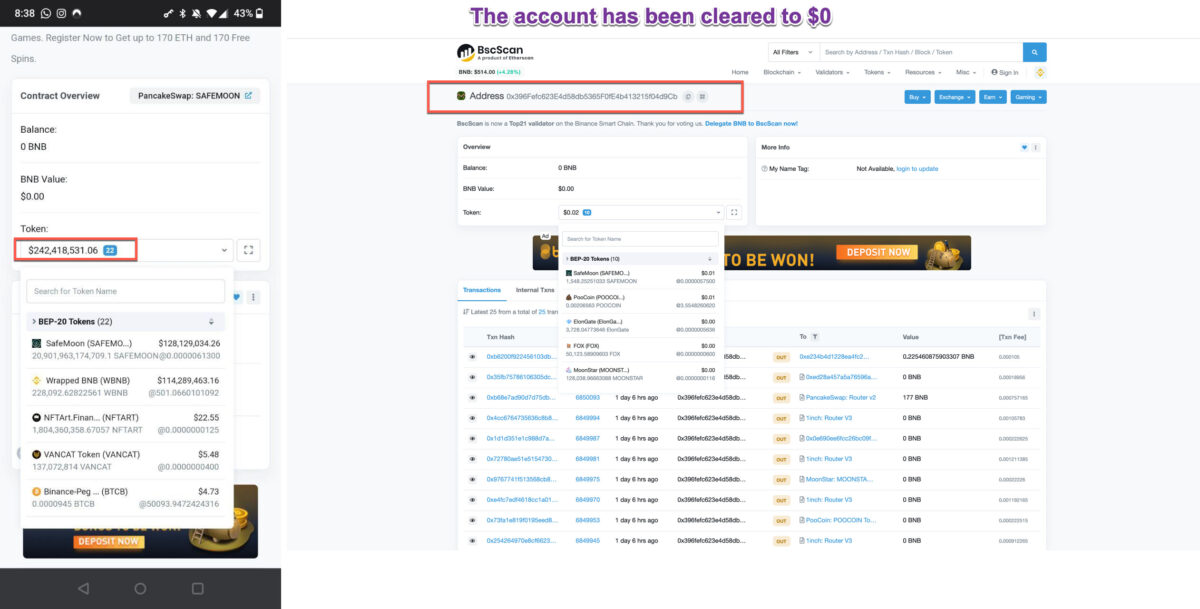

One account had a balance of over $240 million, and another had over $30 million. These accounts have since been cleared to $0. In the crypto world, all accounts and transactions are public information. It’s just that the account owners are anonymous. The number of people affected is unclear. Before the presale ended, elonfarms had attracted $725,000 investments. According to one victim going by the pseudo name of “Mr. Ray,” there were over 3,000 investors in the Telegram group “ElonFarms.”

Mr. Ray lives in the midwestern United States and is a pipeliner in his mid-20s. He has been investing in cryptocurrencies to help with family finance since pipeline jobs dwindled earlier this year. He grew an initial investment of $600 to $6,600.

He said he was excited and stayed up late to claim the tokens as soon as the presale ended on April 24. He didn’t receive any tokens. And, after an hour later, he got a notification on his phone that his assets were transferred.

“I just couldn’t believe it!” said Mr. Ray. His first reaction was “no, no, no.” All he saw on his end was to approve the transfer fee to receive the presale tokens worth $300. Yet, he lost all the tokens he had in his Trust Wallet, a cryptocurrency wallet product holding all his digital assets.

“The $6,000 could have helped buy me time until the pipeline settles out. Any bit helps in these troubling times,” he said.

“It was a source of pride to be able to show my wife our gains and let her know that even though I can’t work right now, I’m still making steps in the right direction for our future. To be set back months of effort was just really hard on me, mentally at that moment,” he shared with The Epoch Times. “I have come to terms with the loss. I hope those responsible for hurting so many people get their fair shares.”

He didn’t report to the police but has been collecting information to provide tips to the FBI.

“Catch them and put them in jail”

Another investor who goes with his Telegram screenname “Mr. Crypto” didn’t buy the presale coins but invested $100 in one of the farms associated with the elonfarms coin launch to receive interest payment over his investment. He accepted the contract and confirmed the investment.

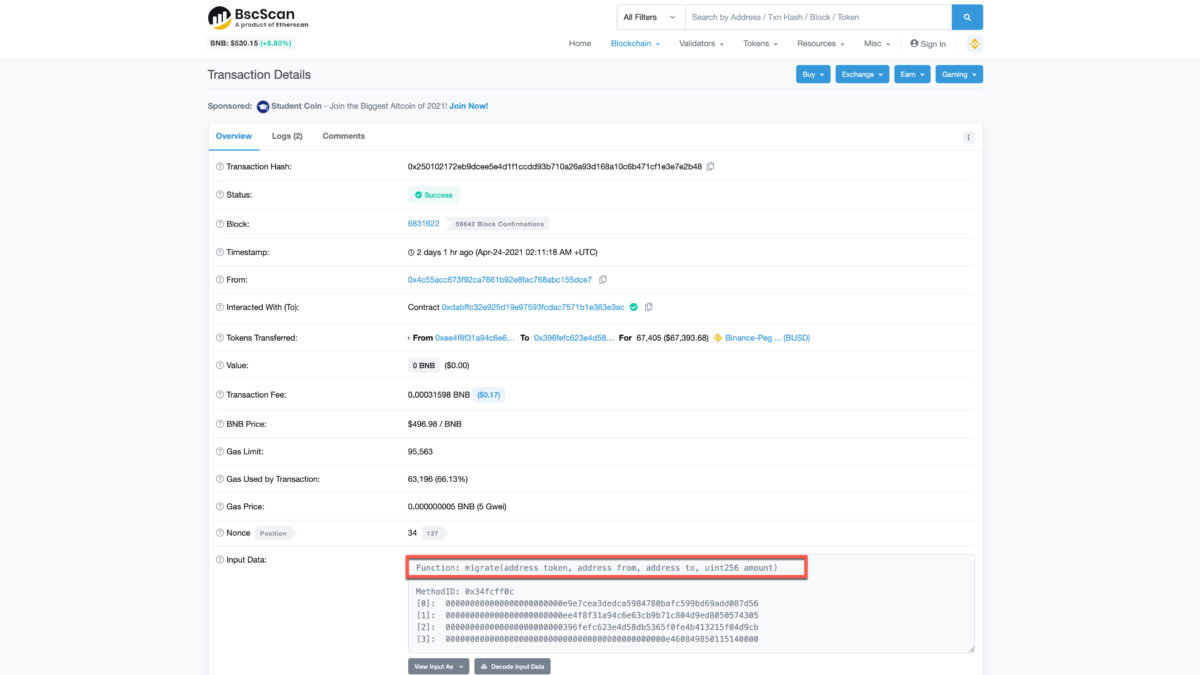

A few days later, shortly after eastern time 11 p.m. on April 23, he was watching T.V. and got a notification from Trust Wallet that $67,400 was sent. He said he checked the transaction details and realized that the elonfarms contract creator had migrated his tokens from his wallet to another. “That’s when I knew that I was scammed.” He immediately revoked all permissions to his wallet to prevent further losses.

“I know how these things are, and you can never recover the money. It sucks. I’ll make it back.” Mr. Crytpo, a 34-year-old Canadian commercial real estate developer and software developer who has invested in cryptocurrencies since 2017. He said he wouldn’t use Trust Wallet again.

Mr. Crypto reported the scam on the Binance community board and the FBI Internet Crime Complaint Center. “I don’t care so much about getting my money back as catching them and putting them in jail.” The Epoch Times has reached out to the FBI for comments.

The $240 Million Account

Jon (pseudo name), a Canadian and advertising professional in his late 30s, lost about $9,000. He took a look at the destination account that his tokens were migrated to and saw the account worth over $240 million at one time.

He sent out the link to the account, and another member of the “ElonFarmsRugPool” Telegram group took the screenshot, which unfortunately doesn’t include the account address. However, Jon confirmed with The Epoch Times that the screenshot was from the account he shared with the group and that the current balance has become $0.

He said he was aware of the risk; therefore, he only agreed to invest about $50 worth of tokens but lost $9,000 due to unknown authorization of access to his wallet. He said elonfarms was “theft.” It was not just another crypto project that didn’t go anywhere after launch.

“I think it’s just unfortunate this scam happened here. It feeds into the narrative that people want to hear about cryptocurrency that it is just full of hackers on the web, or we’re just trying to steal stuff from you and use the funds to do illegal stuff, which isn’t true,” added Jon.

A Potential Security Loophole

Members of the “ElonFarmsRugPool” Telegram group also discussed a potential security loophole with Trust Wallet, the official wallet product of Binance, the exchange on which the elonfarms cryptocurrency was issued. In comparison, they said that Metamask, another cryptocurrency wallet, warned and protected its users.

Mr. Crypto said that he had always been using Metamask, but started using Trust Wallet after a graphical error was found on Metamask’s iOS version. His friend who writes smart contracts for digital assets examined the $67,400 transaction for him. The friend told him that the contract was for access to all of the tokens in his wallet. His friend also sent him a warning screenshot on Metamask when testing out the contract. However, no such warning appeared in Trust Wallet.

Mr. Ray echoed Mr. Crytpo: “Trust wallet didn’t warn me that, hey, you’re about to give access of all of your asset holdings to these people.”

The Epoch Times has reached out to Binance for comments. Trust Wallet is one of Binance’s products.

Regulatory Outlook

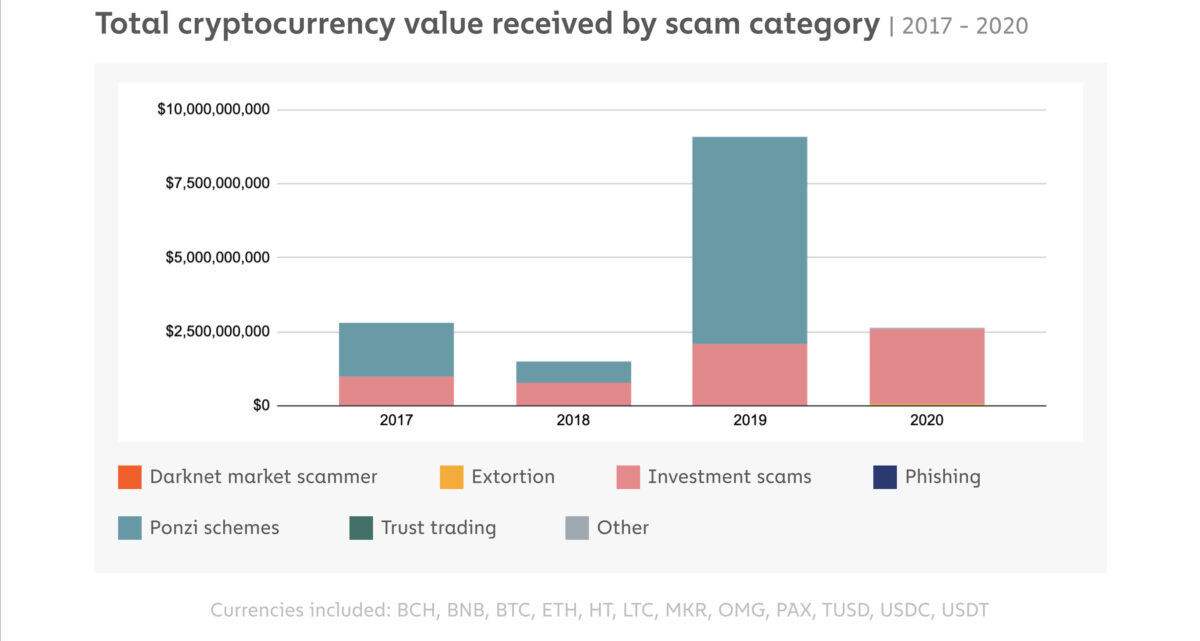

According to Chainalysis, an analysis firm on the cryptocurrency market, the total cryptocurrency value received by scams dropped significantly from 2019 to 2020. Yet the investment scams have shown steady growth.

Richard Hecker, the founder of the Crypto Working Group (CWG), said the smart contracts of cryptocurrencies are computer code, so they need to be audited. He told The Epoch Times, “There are tons of ways to commit fraud in cryptocurrency. There’s a lot of places where there are leakage and issues. There’s no perfect way to investigate any of this stuff, especially if it’s offshore. In the United States, eventually, the government can figure out the scam and arrest people. But when you’re dealing with anything that’s offshore, it’s really hard.”

He founded the CWG, a global cryptocurrency community organization, in 2017. CWG worked with many government agencies, federal and New York State, to educate them on cryptocurrencies. He now focuses on cryptocurrency mining and distributing mining hardware.

“It sounds like Binance is going to be having a big headache with the SEC (Security Exchange Commission) from now on,” David Drake told The Epoch Times. Regarding some victims’ Telegram comments that Binance should vet the issuers on its exchange, Drake said, “Absolutely. That’s why they have Binance U.S. and Binance.” He is the founder and chairman at LDJ Capital and runs a single-family office investing in crypto in the last decade.

The new SEC chair Gary Gensler told lawmakers at his confirmation hearing on March 2, “Bitcoin and other cryptocurrencies brought new thinking to payments but raised new issues of investor protection we still need to attend to.” He said the SEC would provide “guidance and clarity” to the crypto world. The Epoch Times has contacted SEC for comments about upcoming regulations.

On April 22, the House passed a bipartisan bill, “Eliminate Barriers to Innovation Act of 2021” (H.R. 1602). If passed by the Senate and enacted into law, it would create the first crypto task force on digital assets. The task force will have representatives from the SEC and CFTC (Commodity Futures Trading Commission) to regulate crypto securities and commodities.

In the morning of April 24, Elon Musk tweeted, “What does the future hodl?” “Hodl” is not a typo; it stands for “hold on for dear life,” a term referring to the buy-and-hold strategy with cryptocurrencies. Within hours, a “future hodl” token was launching, and the announcement cited Musk’s tweet.

I’m sorry for all the poor people who got ripped off. It seems Binance is a bad bet and hopefully they can be sued by the people who got trashed.