Election 2018: Democratic leaders say they plan to run this November on the promise of repealing parts President Trump’s tax cuts if elected. Should someone tell them that they’ve already lost this debate?

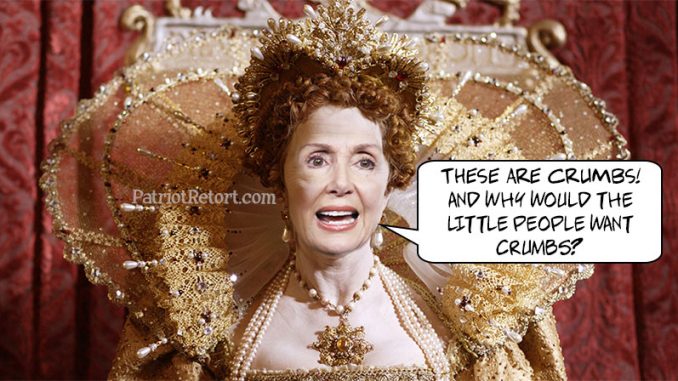

“It may have to be a ‘replace and repeal’ — replace them and repeal the bill,” said House Minority Leader Nancy Pelosi, according to The Hill. She’s urging members to hold “teach-ins” in their districts to explain “what this tax scam means to families.”

Of course, Democrats — not one of whom voted for the tax cuts — aren’t providing any specifics about what parts of the new tax law they would actually repeal, or what they’d replace it with. And for good reason, since the individual parts of the GOP “tax scam” are hugely popular.

Here’s a handy checklist of the key features, and the support they get from the public, according to the most recent Harvard-Harris poll.

- Lower tax brackets for middle class families: 84% support.

- Doubling of the child tax credit: 82%.

- A near doubling of the standard deduction: 81%.

- A 23% tax deduction for small business “pass-through” income: 77%.

- A cap on mortgage interest deductions: 74%.

- Lower the threshold — from 10% to 7.5% of income — to deduct medical expenses: 70% support.

- Repeal of the ObamaCare mandate tax penalty: 63%.

- A special 14.5% repatriation tax rate on earnings held overseas: 60%.

- Elimination of the Alternative Minimum Tax for businesses and an increase in the AMT threshold for individuals: 56%

- A cap on state and local tax deductions: 52%.

Since Democrats aren’t going to volunteer information on which of these provisions they plan to repeal, we would encourage voters to demand specifics.

Perhaps Democrats will only push to repeal the lower corporate income tax rate of 21%, or to raise the top marginal rate back to 39.6%, in the name of sticking it to “the rich.”

But even these provisions get 46% approval. And this number is likely to climb as the public has time to digest the seemingly endless stream of reports about bonuses, pay raises and massive new investments all sparked by the corporate tax cuts.

As we noted in this space earlier, not only are the specific provisions of the GOP tax bill overwhelmingly popular — when they are explained to people — the entire tax bill is gaining in popularity.

The New York Times saw a nine-point increase in approval between December and mid-January. A new Monmouth University poll found that approval went from 26% in December to 44% in January. In both polls, disapproval of the tax law is now below 50%.

Monmouth also found that the share of people who think their taxes will go up fell from 50% in December to 36% in January.

Trump’s State of the Union speech, in which he detailed the tax provisions and the benefits, will likely goose these approval numbers. A CNN snap poll after the speech found that 62% say the tax provisions Trump talked about “will move the country in the right direction.”

Plus, workers are starting to see bigger take-home pay, thanks to the new lower withholding rates, which will cause millions to discover that Democrats have been lying to them about the tax bill all along. Telling these workers that this money is “crumbs” will only make Democrats seem more disconnected from reality.

When you’re losing an argument, the best thing to do is stop arguing.

Source: Investors Business Daily

Be the first to comment