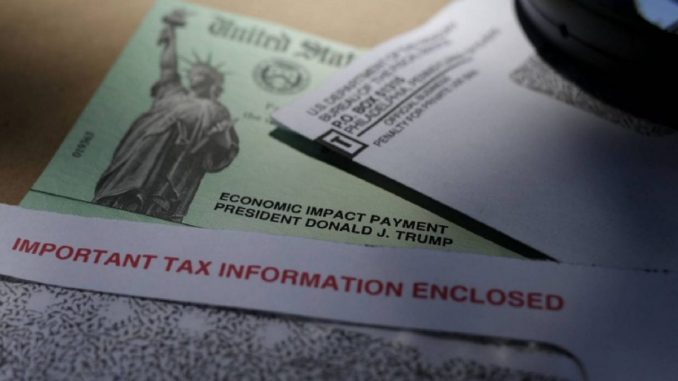

FILE – In this April file photo, President Donald Trump’s name is seen on a stimulus check issued by the IRS. (AP Photo/Eric Gay, File)

OAN Newsroom

UPDATED 9:03 AM PT – Monday, March 8, 2021

Millions of eligible Americans never received their stimulus checks in 2020. According to the Treasury Department on Monday, nearly 8 million taxpayers didn’t get their direct payments from previously passed stimulus bills.

According to reports, the Internal Revenue Service (IRS) was unable to send the payments to individuals who did not file a tax return for 2018 or 2019. However, those who missed the payment can still claim a refundable credit on their 2020 tax return.

“But for taxpayers, this stimulus payment turns into a refundable credit on their 2020 tax return if they didn’t receive it, so both the first stimulus and the second stimulus need to be reconciled on the taxpayer’s 2020 tax return,” explained Michelle Staebell, a certified public accountant. “And then how ever much the taxpayer should have received that they haven’t received, will be refunded when they file their tax return.”

17M Americans ineligible for stimulus payments, reduced payment amount and narrowed cutoff leaves critics fuming – https://t.co/on8dNpg0o2 #OANN pic.twitter.com/nZfKKDLtFt

— One America News (@OANN) March 7, 2021

Experts have said the credit could be deducted if an individual has any outstanding debts with the IRS. Meanwhile, individuals like students and low income families who made less than the $1,200 tax filing minimum were not included in payment rounds.

Be the first to comment