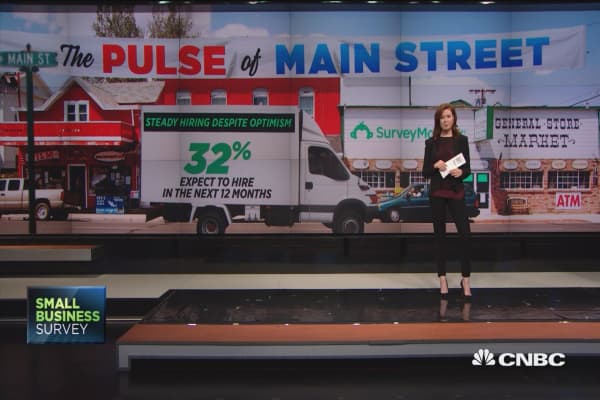

The CNBC/SurveyMonkey Q1 Small Business Confidence Index saw an increase of five points, from 57 to 62, a record high and the largest quarter-to-quarter move the index has seen since CNBC and SurveyMonkey began measuring last year. This is the first survey since President Donald Trump signed the Tax Cuts and Jobs Act into law on December 22, 2017.

In the Q4 survey, small-business owners were split evenly on the core question about the effect that tax policy would have on their business. Opinions have shifted significantly: Twice as many now expect changes in tax policy to have a positive rather than negative effect on their businesses. Forty-six percent of those surveyed say tax policy changes will have a positive effect, up from 38 percent in the fourth quarter. The number of those saying tax policy changes will have a negative impact fell sharply, from 36 percent in the fourth quarter to 23 percent in the most recent survey.

The CNBC/SurveyMonkey data underscores other polling from advocacy groups, including the conservative lobbying group the National Federation of Independent Business. Its latest monthly optimism report for January 2018 showed the second-highest level of sentiment since Trump took office. The report also had its highest yearly average ever in 2017.

“These numbers are historically high,” Juanita Duggan, president and CEO of the NFIB, told CNBC. “This shows small-business owners are more than just optimistic, they are ready to grow their business.”

The National Small Business Association, a nonpartisan lobbying group, also recently released its Year-End Economic Report for 2017, which found that more than half of small-business owners feel the national economy is doing better than it was just six months ago. This is compared to 43 percent who reported the same in December 2016, and only 20 percent in December 2015. In addition, 59 percent said they anticipate economic expansion in the next year, and more than one-third of small-business owners said they felt very confident about the future of their own business, the highest level in more than a decade.

“I think the jump in optimism isn’t just due to tax reform, but largely due to the economy doing better,” said Molly Day, vice president of public affairs for the NSBA. “Certainly, the tax-reform piece is helpful, but in reality I think small businesses are just now starting to digest what it means for their business.”

Health care and hiring remain big challenges

Despite the optimistic outlook, challenges remain on Main Street. Small-business owners are looking to Washington for progress on additional issues, including health-care reform. CNBC and SurveyMonkey found that 30 percent of business owners say they want Congress to tackle health care, with 2 in 10 now reporting the cost of employee health care as the most critical issue facing their business. The NSBA’s data also found the cost of health insurance to be the most significant challenge to the future growth and survival of small firms.

“I think that because of the cost of health care, hiring among the smallest businesses won’t be changed significantly,” Day said. She added that in the NSBA’s opinion, tax reform isn’t done.

“There was a tax cut, but very little was accomplished in terms of small-business parity with larger businesses,” Day contended. “Complexity wasn’t touched at all, and the administrative burdens of federal taxes are actually a bigger problem for small firms than the financial cost of taxes.”

She added: “The growing debt is still a major concern for small-business owners.”

Another key area of concern for small businesses is finding skilled labor. In the NFIB’s data, the quality of labor is now the top issue. Hiring is challenging, and more businesses are raising wages in order to hang on to the workers they have. The NFIB reports worker compensation is at its highest level since 2000.

The CNBC/SurveyMonkey online poll was conducted Jan. 29 through Feb. 5, 2018, among a national sample of 2,080 self-identified small-business owners ages 18 and up, across a wide swath of industries. Respondents were selected from the nearly 3 million people who take surveys on the SurveyMonkey platform each day using its online polling methodology. Responses have a margin of error of +/- 3.5 percentage points.

The Small Business Confidence Index is calculated on a scale from 0–100 and is based on the responses to eight key questions. A zero indicates no confidence, and a score of 100 indicates perfect confidence.

Note: In a misstatement to CNBC, Molly Day originally saidthe administrative burdens of “health care” rather than “federal taxes” are a bigger problem for small firms than the financial cost of taxes.

Be the first to comment